2023 Form 5500 Participant Count Changes

Form 5500 is used to meet the annual reporting requirements for employer sponsored retirement plans. On February 23, 2023, the Department of Labor (DOL) released details on changes to the 2023 Form 5500. Possibly the most significant change to the form involves how participants are counted for determining which retirement plans are eligible for simplified reporting available to certain small plans.

Large plans have significantly more detailed reporting requirements than small plans. Large plans are also required to attach audited plan financial statements to their Form 5500 reporting. Small plans (who meet certain plan requirements) are able to file the much less detailed Form 5500-SF (Short Form) and have no annual audit requirement. Large plan reporting can result in an additional administrative burden and increased professional fees compared to small plans.

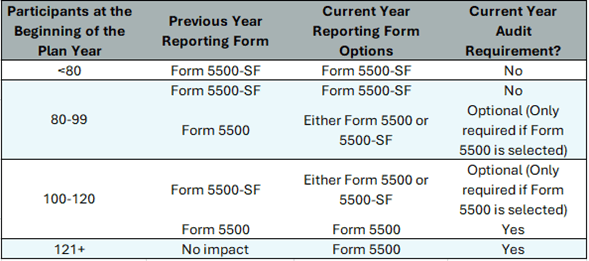

Under current rules, plans with over 100 participants at the start of the plan year are required to file the Form 5500 while those with 100 or less (and that meet certain other requirements) are allowed to file the Form 5500-SF. This is slightly more complicated by the 80-120 rule, which provides the following additional factors in determining filing and audit requirements:

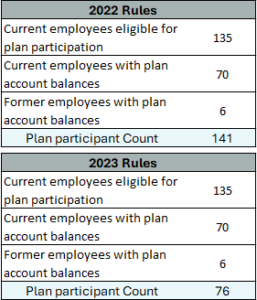

For 2022 and prior Forms 5500, participant counts include participants with account balances AND all eligible participants (regardless of actual participation). For plans with low participation, this can result in large plan reporting requirements even if there are less than 100 participants actually contributing to the plan. Participant counts will still be measured only once per year, at the beginning of the plan year.

The 2023 Form 5500 changes the methodology for counting participants. Under the new rules, only participants with account balances will be included in the overall participant count. Below is an example of how this change could impact a plan that otherwise qualifies for small plan reporting:

In this example, under the 2023 Form 5500 the plan would be considered a small plan. If the plan is otherwise eligible for small plan reporting, this would allow the plan to file the Form 5500-SF. The plan would also not be required to have an annual audit.

For certain plans, this change may impact their reporting options starting in 2023. Please contact your current Copeland Buhl representative or me at Stephanie_Leduc@copelandbuhl.com or (952) 476-7155 if you wish to learn more.